News Summary

Textron Inc. has reported a strong second-quarter profit of $245 million, maintaining a profit per share of $1.35. Additionally, their revenue reached $3.72 billion, exceeding analyst expectations. The company’s adjusted earnings of $1.55 per share surpassed forecasts and demonstrate Textron’s operational strength in the aviation sector, which includes well-known products such as Cessna planes and Bell helicopters. With projections of full-year earnings between $6 to $6.20 per share, Textron shows confidence in its continued growth despite industry challenges.

Providence, Rhode Island

Textron Inc. has announced a strong second-quarter profit of $245 million, reflecting steady performance during the period. This translates to a profit per share of $1.35, which remains consistent with figures reported in the same quarter last year. The company also reported adjusted earnings—excluding any non-recurring costs—of $1.55 per share, exceeding Wall Street expectations that had forecasted earnings of $1.45 per share.

In addition to profits, Textron’s quarterly revenue reached $3.72 billion, outpacing analyst predictions of $3.63 billion. This robust financial performance highlights Textron’s operational strength and ability to meet consumer and market demands amid a fluctuating economic environment.

Company Overview

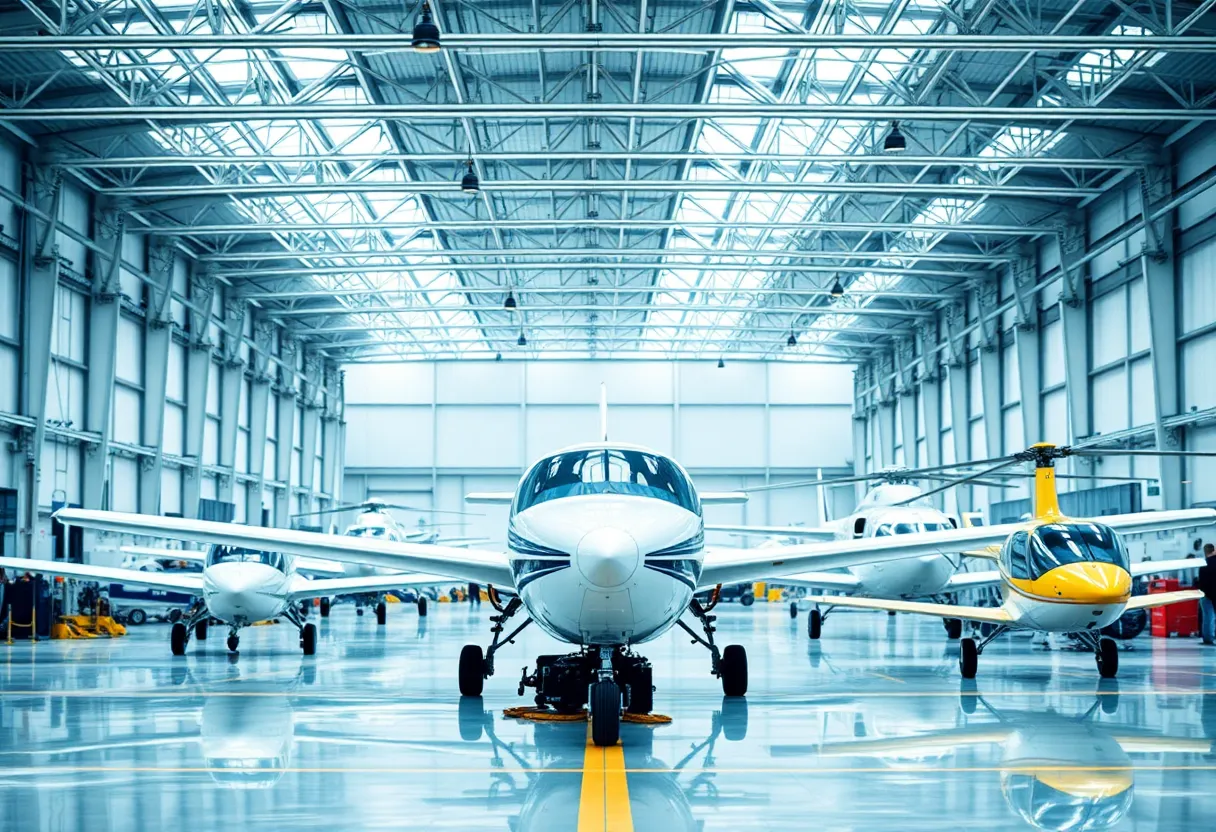

Textron specializes in manufacturing a diverse array of products, including Cessna small planes and Bell helicopters, which are well-regarded in both civilian and military aviation. The company’s reputation for quality in engineering and manufacturing contributes positively to its financial health and market presence.

Future Projections

Looking forward, Textron has set projections for full-year earnings in the range of $6 to $6.20 per share. This forecasting indicates the company’s confidence in continuing its growth trajectory as it navigates the complexities of the current economic landscape.

Investment Context

The reported financial results were based on data gathered from Zacks Investment Research, serving as a valuable resource for market analysts interested in Textron’s performance and investment viability. The exceeding of analyst expectations indicates that Textron remains a competitive player in the markets it serves.

Industry Significance

Textron’s success in the second quarter is significant not only for its investors but also for the broader aviation industry, which continues to face challenges such as supply chain disruptions and fluctuating demand patterns post-pandemic. By surpassing forecasts, Textron showcases resilience and an ability to adapt, which may provide a sense of stability within a tumultuous sector.

Conclusion

With a consistent profit per share and adjusted earnings that surpass expectations, Textron continues on a solid financial path. Stakeholders and analysts alike will be keenly watching the outcomes of Textron’s future quarters, especially in light of industry challenges and its strategic plans for growth.

Deeper Dive: News & Info About This Topic

HERE Resources

Additional Resources

Author: STAFF HERE PROVIDENCE WRITER

The PROVIDENCE STAFF WRITER represents the experienced team at HEREProvidence.com, your go-to source for actionable local news and information in Providence, Providence County, and beyond. Specializing in "news you can use," we cover essential topics like product reviews for personal and business needs, local business directories, politics, real estate trends, neighborhood insights, and state news affecting the area—with deep expertise drawn from years of dedicated reporting and strong community input, including local press releases and business updates. We deliver top reporting on high-value events such as WaterFire, Rhode Island International Film Festival, and Rhode Island Comic Con. Our coverage extends to key organizations like the Greater Providence Chamber of Commerce and Providence Warwick Convention & Visitors Bureau, plus leading businesses in finance and manufacturing that power the local economy such as Citizens Financial Group and Textron. As part of the broader HERE network, we provide comprehensive, credible insights into Rhode Island's dynamic landscape.